Inheriting a property in London can be both a financial blessing and a legal burden.

At London Estate Agency, we specialise in guiding beneficiaries through the complexities of property inheritance with clarity and confidence.

Whether you intend to live in, rent out, or sell the property, there are crucial steps to follow—and key decisions that could impact your financial future.

Below, we’ve outlined everything you need to know to make informed, profitable decisions with your inherited property.

Understanding Probate and Legal Ownership

Before taking any action, you must ensure the probate process is complete. Probate is the legal procedure that confirms the will’s validity (if one exists).

It authorises the executor to administer the estate.

You’ll likely need to apply for a Grant of Probate if you are named in the will.

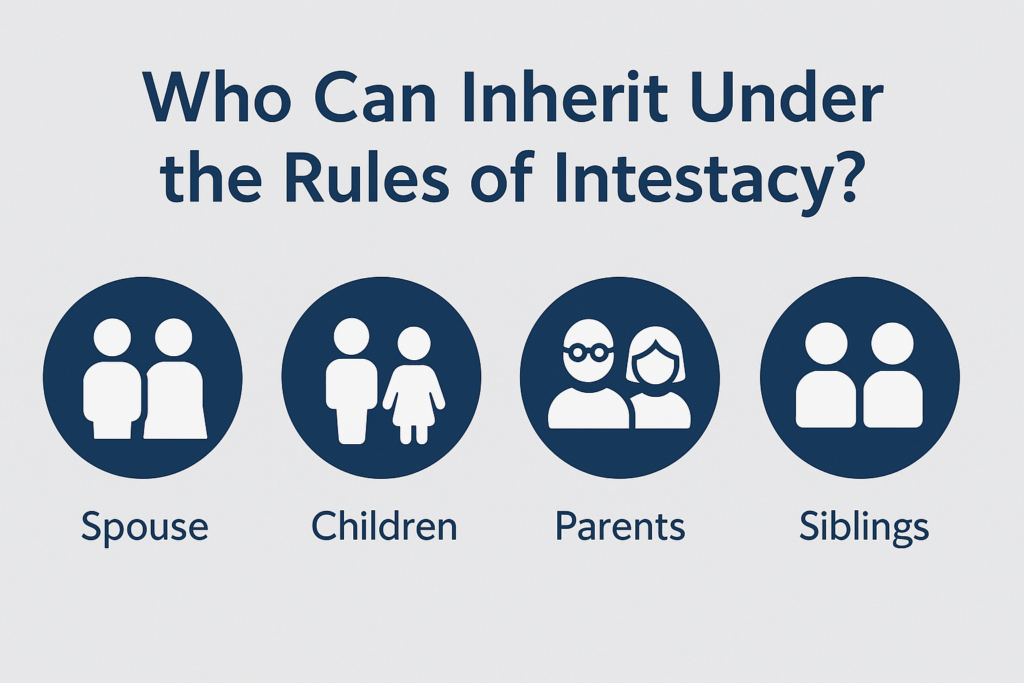

If there is no will, the estate will be managed under intestacy laws, and you’ll apply for Letters of Administration.

Once probate is granted, you become the legal owner of the property and can explore your options.

What are my options For an inherited property?

Sell the Property for Profit

One of the most common routes beneficiaries take is selling the inherited property.

With the London property market being one of the world’s most valuable, this can generate and rate substantial returns—especially if the property has appreciated significantly.

We offer a fast and free property valuation, strategic marketing, and access to pre-qualified buyers, ensuring a smooth and profitable sale.

If the property is in disrepair, we assist with refurbishments or clearing probate properties for market readiness.

Key Advantages:

Instant access to capital

Avoids ongoing maintenance and tax liabilities

We handle all legal, marketing, and sales processes in-house

Let the Property for Ongoing Income

Letting out your inherited property can be a rewarding long-term strategy if you’re looking for passive income.

With a constant rental demand in London, you can benefit from a stable monthly cash flow.

Our in-house services include:

Tenant screening

Rent protection insurance

Full management packages

Energy Performance Certificates (EPCs)

We ensure you comply with all landlord regulations while maximising your rental returns.

Move Into the Property

Another viable option is to live in the inherited home, particularly if it’s mortgage-free.

This can significantly reduce your cost of living and provide a fresh start in a new part of London. Before moving in, consider:

Whether the property needs renovation

If council tax and utilities are in order

Potential capital gains implications if you sell it later

We can assist with renovation services and legal title transfers and ensure the transition is hassle-free.

Refurbish and Flip for Higher Profits

Many beneficiaries refurbish the property and resell it for a higher value—a strategy known as “flipping.”

We specialise in helping our clients identify the most valuable upgrades and improvements to increase resale value quickly.

Our services include:

Trusted tradespeople for probate property renovations

Interior staging

Before-and-after marketing packages

We help you transform tired properties into top-market assets.

Transfer Ownership or Gift the Property

You also have the option to transfer ownership to another family member or gift the property.

However, this can involve Capital Gains Tax or Inheritance Tax considerations.

We recommend speaking with our property tax advisors to explore how this can be structured most efficiently and legally.

Understanding the Taxes Involved

Inheriting a property can trigger several tax responsibilities depending on your actions. Here’s what you need to consider:

Inheritance Tax (IHT)

This applies if the total estate value exceeds £325,000

Charged at 40% on the amount above the threshold

If you inherit from a spouse or civil partner, you may qualify for additional relief

Capital Gains Tax (CGT)

Only applies if the property value increases between inheritance and sale

If you sell the property, you may owe CGT on the gain

Stamp Duty

You do not pay Stamp Duty when you inherit a property, but future buyers or transferees may be liable.

Our tax specialists can help you minimise liabilities and take advantage of available reliefs and exemptions.

Responsibilities After Inheriting Property

In addition to deciding what to do with the property, you also assume responsibilities such as:

Council Tax and Utility Bills

Building Insurance

Securing the Property

Compliance with Fire, Safety, and EPC regulations

We take the burden off your shoulders with complete property management services designed for inherited estates.

How We Help You Navigate Inherited Properties

At London Estate Agency, we provide end-to-end solutions tailored to your situation. Our specialised probate property team can:

Apply for Probate on Your Behalf

Arrange Probate Property Valuations

Sell or Let the Property Efficiently

Manage All Legal and Tax Paperwork

Offer Rent Protection and Tenant Screening Services

Whether you want to sell quickly, rent securely, or explore your options, we make the process effortless.

FAQs About Inheriting Property in London

What happens if the property is shared between siblings?

If you inherit the property with others, you’ll need to come to a mutual agreement on whether to sell, rent, or transfer shares.

We mediate these discussions and handle the legal complexities of joint ownership or partition sales.

Do I need to pay tax immediately?

You generally have 6 months from death to pay any Inheritance Tax.

Interest may be charged after that. We help you understand deadlines and even connect you with financing options if needed.

Can I sell the property before probate is granted?

You must wait until the probate is complete to legally legally transfer or sell the property.

However, we can start the marketing and valuation process early so you’re ready to sell when probate is granted.

What if the property has tenants?

You’ll need to comply with all existing tenancy agreements.

We assist in continuing the tenancy, serving notice legally, or negotiating a settlement to regain possession.

Is it better to keep or sell an inherited property?

That depends on your financial goals, the property’s condition, and the market climate.

We provide personalised consultations to help you choose the most profitable route.

Contact London Estate Agency today to discuss your inherited property.

We make probate property management simple, secure, and profitable. Our team will take care of everything—so you can focus on your future.